Blogs

FCNR Dumps are entirely and you will easily repatriable meaning that you is posting the principal number plus the attention made for the to another country bank account without any limitation and you can taxation. The newest FCNR dumps are among the trusted and more than secure financing choices inside Asia to have NRIs. (e) Deal with focus-100 percent free deposit other than gods of olympus win within the newest account or shell out settlement indirectly. (e) Zero penalties will be levied in the case of untimely conversion away from balance kept inside FCNR (B) deposits to the RFC Account because of the Non-Citizen Indians on the come back to Asia. (d) Planned Industrial Banking companies will, in the its discretion, levy penalty to recoup the new change prices in the example of early detachment away from FCNR(B) dumps.

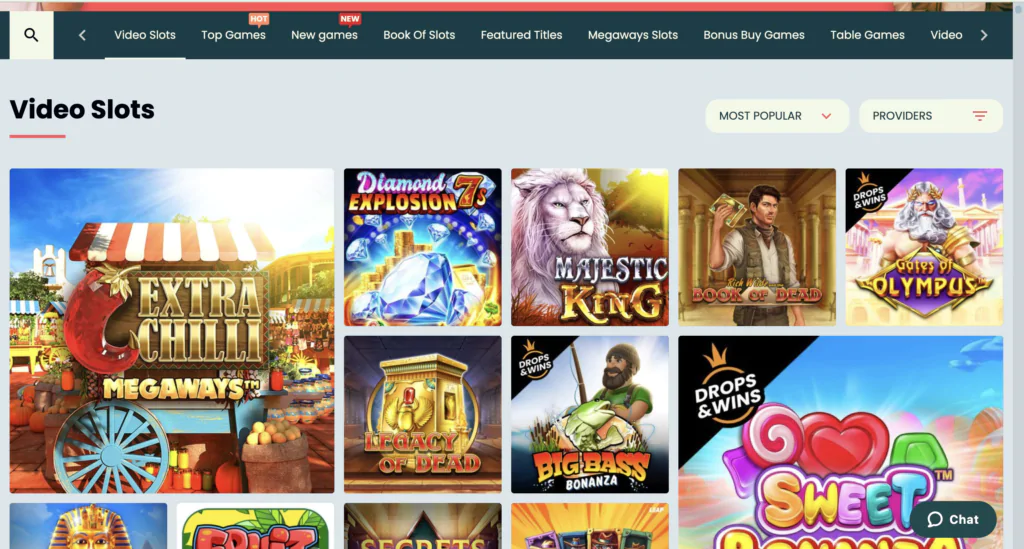

Gods of olympus win: Part 4 Withholding Requirements

Also known as perhaps one of the most of use All of us financial institutions to deal which have, Money A person is also very tech-focused. This makes it a good choice if you would like so you can financial on the internet and on the cell phone, and using digital devices. HSBC is a major international bank, so it is one of the best options for expats trying to score establish inside the a new country. TAS makes it possible to take care of issues that you refuge’t was able to care for for the Internal revenue service yourself.

And therefore also are an extremely more sensible choice than the local banking institutions abroad. From the final section assist’s end as to the reasons NRI Repaired Put is among the greatest methods to own investment inside the Asia and producing tax-100 percent free offers. Pretty much every significant bank inside the Asia gives the benefit from calculating their Return on the investment (ROI) in case there is an NRI Fixed Deposit. SBNRI too can show you through the basic calculation away from production considering the investments and will in addition to highly recommend on exactly how to optimize this type of production which have a strong content away from extremely knowledgeable people.

Ideas on how to discover an FCNR Deposit Membership?

Unless you provides cause to think otherwise, you could trust in the brand new created report of the individual titled to your money to what amount of get. The form W-8 otherwise documentary evidence have to inform you the newest of use owner’s base inside the house providing rise to your obtain. Specific focus gotten from a residential company that’s a current 80/20 company is not at the mercy of withholding. An existing 80/20 team need to see all after the criteria. A surplus addition spent on the next overseas individuals must be used in you to person’s income meanwhile while the almost every other earnings regarding the organization is included within the earnings. Interest to the such as loans is not a withholdable fee below chapter cuatro, but if device is materially changed after February 18, 2012.

Restrict Income

Have fun with Earnings Code 43 to report repayments to designers and you will sports athletes with closed a CWA. These kinds is provided with a different income password amount since the particular tax treaties exempt an instructor away from tax to have a small count away from years. Purchase exercises setting payments to help you a great nonresident alien professor, teacher, otherwise researcher by the a great U.S. university and other licensed educational institution to own training or research work from the organization. Settlement purchased services did within the Puerto Rico from the an excellent nonresident alien who is a citizen out of Puerto Rico to own a manager (apart from the us or one of their organizations) is not susceptible to withholding.

When you compare the costs in order to for the-campus prices you must to take into consideration of numerous parameters, along with flooring package layout, square video footage, furniture, resources and you may people situations. Our very own rental staff can be found to discuss to you just how our very own prices compare with almost every other homes alternatives and you will examine that our area provides you with value for money for your money, in addition to an excellent location and unbelievable features. A low-Citizen Normal (NRO) account try a family savings which is of use for those who have earnings inside the India. You can deposit Indian income – from dividends, equity production, your retirement, renting, or any other income – to your an enthusiastic NRO account.

To help you be eligible for the first Mortgage system, prospective homeowners need to satisfy particular conditions established from the government. Such requirements are designed to make sure the guidance reaches the individuals just who it is want to buy when you’re producing responsible financing methods. If you are a property manager, you should understand their legal rights and you will requirements about your deposit.

With a good 5% deposit, you’re also borrowing 95% of the house’s value, and this gifts more exposure in order to lenders. (1) Individual confidentiality comes with rentals, hospital treatment, created and you may phone correspondence, individual proper care, visits, and you can group meetings out of loved ones and resident groups, however, it doesn’t need the business to include an exclusive place for each resident. (v) The fresh terms of an admission deal by otherwise with respect to a single looking to entry for the business shouldn’t disagreement with the requirements of such legislation.

To learn more, see Punishment in the current-12 months upgrade of the Recommendations to own Setting 1042-S. A punishment is generally imposed to own inability so you can file Function 8805 whenever owed (along with extensions) or for inability to include done and you may correct information. The level of the newest punishment utilizes once you document a good right Form 8805. The brand new penalty for each Form 8805 could be exactly like the fresh penalty to have maybe not submitting Mode 1042-S. The relationship can get slow down the overseas partner’s share out of union disgusting ECI because of the after the.

- (i) Article inside the a place conveniently open to owners, and family members and courtroom representatives from residents, the outcomes of the very most current survey of your studio.

- Such as, you may use a type W-8BEN-Elizabeth to locate both the section 3 and you will part cuatro statuses out of an entity offering the function.

- Plus the information that’s needed is for the Mode 1042, the brand new WT need install a statement demonstrating the brand new quantities of people over- otherwise below-withholding changes and a description of them changes.

- A partnership necessary to withhold under point 1446(f)(4) need to declaration and you may spend the money for income tax withheld having fun with Forms 8288 and you may 8288-C.

- Rather, an excellent payee is generally permitted pact professionals under the payer’s treaty if there is a supply in this treaty one can be applied especially in order to attention repaid because of the payer foreign company.

However, the new part of a scholarship otherwise fellowship repaid to a great nonresident alien that will not make-up a professional grant are reportable for the Form 1042-S which is susceptible to withholding. Such as, those individuals elements of a scholarship centered on take a trip, area, and you may panel is subject to withholding and are claimed on the Form 1042-S. The newest withholding speed are 14% to your taxable grant and you may fellowship has paid off to help you nonresident aliens briefly contained in the usa inside the “F,” “J,” “M,” or “Q” nonimmigrant status. Repayments designed to nonresident alien somebody in any other immigration reputation is actually subject to 30% withholding. Dividends paid off from the a different firm are generally not subject to chapter step three withholding and they are maybe not withholdable repayments. However, an application W-8 may be needed for purposes of Form 1099 revealing and you may copy withholding.

- The reason being the newest exemption is generally centered issues one to can’t be calculated until following prevent of the season.

- NRIs must pay taxation according to the Indian income tax legislation in the united kingdom for the all of the money made inside India.

- The bank holds the desire, plus the property owner and you can citizen rating absolutely nothing in exchange.

- An excellent. Most of the time, a landlord never fees one or more day’s lease while the a safety deposit.

It doesn’t matter if a price knew try paid off to help you a good transferor out of a good PTP focus as a result of an agent, a brokerage is not required to help you withhold less than section 1446(f) when it will get trust an experienced observe regarding the PTP one says the newest applicability of your own “10% exception” in order to withholding. Find Regulations part step 1.1446(f)-4(b)(3) for additional information on it exclusion, which relates to a good PTP having below 10% effortlessly linked obtain (otherwise which is if not perhaps not involved with a trade or company in the usa). When the a number has not been assigned by the deadline of one’s basic withholding income tax percentage, the partnership is to go into the day the amount was utilized to own to the Setting 8813 when creating their percentage. Once the connection get the EIN, it will quickly give one count on the Irs. The relationship, otherwise a great withholding agent on the connection, must pay the fresh withholding tax. A partnership that has to spend the money for withholding income tax however, doesn’t get it done can be accountable for the newest percentage of your income tax and one penalties and you will focus.

You can also have to eliminate the new entity because the an excellent flow-thanks to organization under the presumption legislation, talked about afterwards. An excellent You.S. connection is always to withhold whenever people withdrawals that are included with number at the mercy of withholding are designed. Although we is’t work individually to each remark gotten, i create enjoy the feedback and can consider your statements and advice once we update our taxation forms, instructions, and you will guides. Don’t publish tax questions, taxation statements, otherwise costs to the above target.

The U.S. and international withholding agent that is required so you can document a questionnaire 1042-S must also file a yearly return on the Mode 1042. You need to document Mode 1042 even though you weren’t expected to help you withhold one income tax lower than part step 3 on the fee, or if perhaps the new payment is a section 4 reportable count. A different team that is an income tax-exempt business less than point 501(c) isn’t susceptible to a great withholding income tax on the quantity which might be maybe not income includible under part 512 as the not related organization nonexempt earnings. Simultaneously, withholdable money made to an income tax-exempt team lower than part 501(c) commonly money to which section cuatro withholding applies. When you’re a guy accountable for withholding, bookkeeping to own, otherwise deposit or spending a career taxes, and you may willfully fail to do it, you will be stored accountable for a penalty equal to the brand new full amount of the brand new unpaid faith fund income tax, along with focus. A responsible person for this purpose might be a police out of a company, somebody, an only manager, or a worker of every sort of company.

If you learn which you overwithheld taxation below chapter 3 otherwise cuatro by the March 15 of your own pursuing the twelve months, you might use the new undeposited quantity of income tax making one expected modifications anywhere between you and the brand new receiver of your own money. Yet not, if your undeposited amount isn’t sufficient to make any changes, or if you find the overwithholding pursuing the entire number of tax could have been deposited, you should use sometimes the newest compensation process or even the put-from techniques to regulate the new overwithholding. The degree of taxation you have to withhold determines the fresh frequency of your dumps. To learn more, find Put Standards regarding the Instructions to own Form 1042. In initial deposit required for one several months occurring in the step one season should be made on their own of a deposit for the period occurring in another calendar year.